Hurricane Claims Attorney in Baton Rouge

Did you know that hurricane Ida was the second-most damaging hurricane making landfall in Louisiana on record? During the storm and its aftermath, a total of 107 people passed away. Even those that survived, had to endure damage to their homes and livelihoods.

Because storms are unfortunately common along the gulf coast, Louisianans prepare for them every year by stocking up on sandbags, beer, and other major necessities. However, sometimes damages might occur despite the best planning.

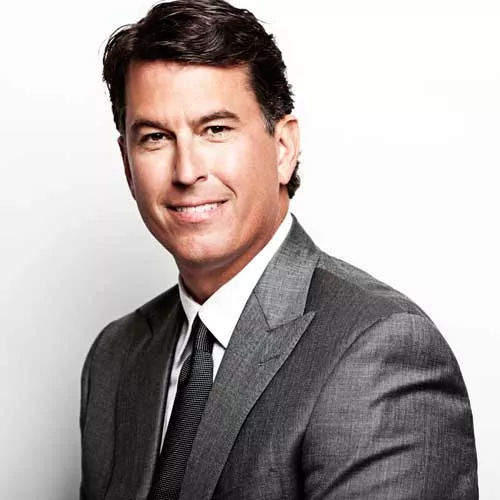

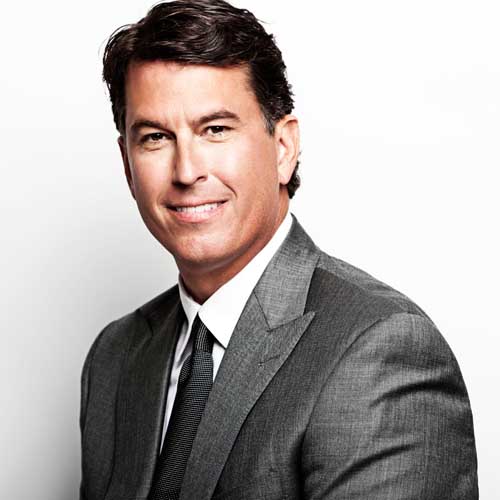

If you’ve experienced damage due to a hurricane, you deserve a dependable hurricane claims attorney to help you gain the compensation you need to move forward with your life. Gordon McKernan Injury Attorneys have experienced Louisiana personal injury lawyers who understand the complex challenges of living in our state. We encourage you to give us a call today.

Click to Contact Our Baton Rouge Hurricane Claims Attorneys Today

What to Do if Your Home is Damaged in a Hurricane

First and foremost, in order to prevent anyone in your family from getting sick or hurt because of contaminated food, water, structures, or facilities, it’s important to take care of your basic physical needs. Then, you can take steps to protect your property from further damage by having professional contractors, inspectors, or appraisers review the extent of the damages.

In order to determine your coverage and the conditions of your insurance, you should then speak with a hurricane claims attorney who can look over your policy and send a notice to the insurance agency about your damages. Doing this on your own can possibly hurt your ability to file a successful hurricane insurance claim.

Common Types of Hurricane Damage

Hurricanes are extremely violent storms that can cause substantial damage to your home and property. High gusts, heavy rains, and potential flooding can all add up to hundreds of thousands of dollars in damage. Some of the most common hurricane damages include:

- Equipment damage – A big concern during and after a hurricane is damage to heating and air conditioning systems, appliances, generators, and other equipment.

- Roof damage can result from the strong winds of a hurricane, and in some severe cases, roofs can completely collapse.

- Utility damage can also happen due to strong winds, affecting power lines, telephone lines, internet, and water lines for long periods of time.

- Structural and foundation damage can make a home unlivable, especially if cracks are in the foundation.

- Interior damage occurs when a storm tears off the roof of a building, shatters windows, or otherwise fractures the structure, and can involve water damage, mold growth, and other problems.

A thorough hurricane season preparation is the best approach to help avoid these damages. However, keep in mind that even with all the preparation, a hurricane can still significantly harm your home, property, and livelihood.

As a homeowner or business owner who experienced property damage in a storm, you may wonder whether you need to involve an attorney. Every case is different, and whether you need an attorney’s help will depend on your unique situation. However, we can offer a few helpful tips to know when you might need to seek counsel.

When to Involve Hurricane Insurance Claims Attorney

If a storm caused property damage to your house or place of business, you might be wondering whether you need to consult an attorney. Every case is different, and your particular circumstance will determine whether you need legal assistance. However, we can provide some useful advice to help you determine when you might need to consult a lawyer.

You May Need a Hurricane Claims Attorney If:

- The catastrophic damage to your property requires lengthy and expensive repairs.

- The degree of the damage is not agreed upon by the insurance adjuster and you.

- Although your insurance provider claims you are not covered, you feel you should be.

- You’re seeing delays or are having issues getting the insurance provider to respond.

- There are several distinct types of hurricane damage (wind, flood, etc.).

8 Steps To Filing an Insurance Claim After a Hurricane

Following these 8 steps will help you maximize the value of your claim if a hurricane has damaged your home or other property.

- Alert Your Insurance Company – This may include a few different insurers, depending on your damage.

- Structures, property, and other things with water damage are covered by flood insurance.

- Wind damage is typically covered by homeowner’s insurance, but you may need a “wind insurance endorsement” for storm wind damage in Louisiana.

- If your car is damaged, you’ll need to contact your car insurance.

- Document Any and All Damage – This means taking photos and videos of everything that’s been damaged, such as home damage, car damage, fallen trees, flooding, etc.

- Take Inventory – Find all of the damaged, destroyed, or lost items so you can present and include them in your claim. Include purchase receipts from the items if you can to demonstrate their value.

- Create a Claim Log and record everything, including each time you speak with someone, come across something damaged, or submit something.

- Meet your adjuster or adjusters – You can save a lot of time by presenting the insurance adjusters with your own proof that you’ve gathered before they arrive to assess the damage to your property and calculate the value of your claim.

- Request Repair Estimates – Find a dependable contractor to give you a repair estimate for your property. Knowing if your insurance payment will be sufficient to cover your losses will be easier for you to determine if you have an estimate ready to go when you meet with your adjuster.

- Wait – This is perhaps the hardest part, but it can take weeks or even months. You should definitely keep receipts for living, dining out, and other expenses if your house is too damaged to live in while you wait.

- Collect Your Payment – When your check is in the mail, make sure it’s the appropriate amount to cover the repairs to your property. If you find more damage after your initial claim, you can reopen it to cover more repairs.

How Long Do I Have to File a Hurricane Claim in Louisiana?

Many hurricane victims have no clue how long they have to file a hurricane claim. In Louisiana, property owners have 180 days from the catastrophic event to submit a hurricane insurance claim, as per Louisiana law. It’s a good idea to start the procedure as soon as you can, even though you have almost six months so that your hurricane claims attorney can help you gain the compensation you deserve sooner rather than later.

Baton Rouge Hurricane Claims Attorney

Unfortunately, some insurance companies will try to pay out the minimum they can. If your insurance hasn’t provided you with enough to cover your losses from a hurricane you should get in touch with a trustworthy hurricane claims attorney to help you with your claim.

Gordon McKernan Injury Attorneys have worked in Louisiana for decades, and we’ve helped thousands of people with their storm damage claims. Give our team of Louisiana hurricane damage claim attorneys a call at for a free consultation about your legal options.

We have full confidence that we can help you get the money you deserve for your storm damage. As a matter of fact, if we don’t win, you won’t owe us a dime—that’s the .

Baton Rouge Hurricane Claims Attorney Near Me

225.888.8888

How It Works

Filing a claim with Gordon Mckernan Injury Attorneys is easy! Simply follow the steps below.

1

Get Your Free Consultation

2

An Attorney Will Reach Out

3

Get Gordon! Get It Done!

INJURED?

GET HELP NOW!

Baton Rouge Lawyers

Settlements & Verdicts

$25,000

Client Involved in Car Wreck in Baton Rouge, Louisiana

Client was in a car wreck in Baton Rouge, Louisiana. Suffered from back and hand pain.

$1,500,000

Auto accident causes brain injury

Our client was involved in an auto accident that caused our client to suffer a brain injury.

$2,200,000

Vocational School Student Burned By Defective Oxyacetylene Torch

Our client, a vocational school student results in burns by a defective oxyacetylene torch.

$1,450,000

18 Wheeler Accident Causes Herniated Disc & Fractured Elbow

An 18 wheeler accident causes our client to suffer from herniated disc and fractured elbow.

$350,000

18 Wheeler Wreck Resulting in Death

Client was a passenger in a vehicle rear ended by and 18 wheeler. Driver was killed. Case resulted in a $350,000 settlement.

$250,000

Gonzales Motor Vehicle Accident

Client was involved in a serious motor vehicle accident in Gonzales, LA resulting in serious injuries and a settlement of $250,000.

$26,000,000

Class action settlement for chemical exposure

Class action settlement for chemical exposure case.

$8,025,000

Doctor Dies in Helicopter Crash Due to Defect in Fuel Mixture

A doctor dies as a result of a helicopter crash with defective fuel mixture, resulting in $8,025,000 verdict.

$16,000

Car Wreck on Southern University Campus Where Client Suffered Head, Neck & Shoulder Pain

Our client was involved in a car wreck on Southern University campus. Client suffered head, neck and shoulder pain.

Our Accreditations